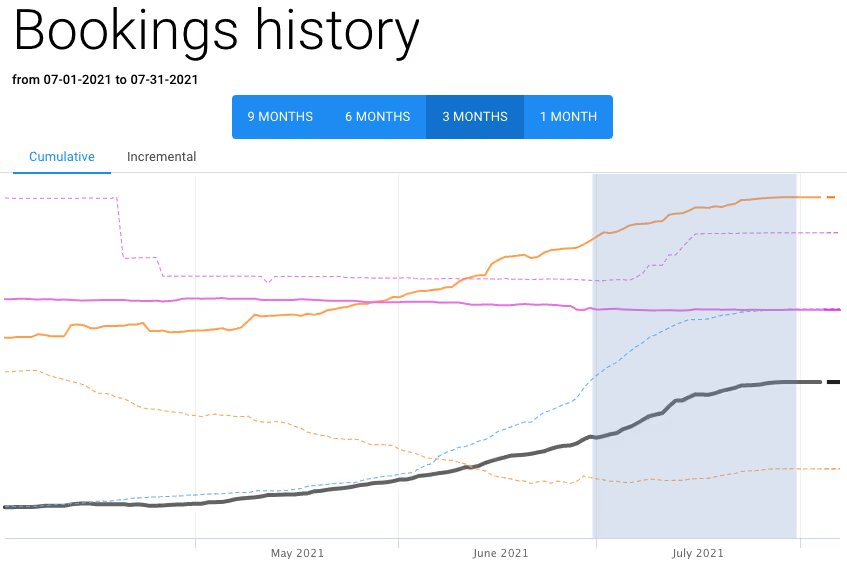

WeYield updated the market trend report for the month of July 2021. Some key points are clearly popping up:

1 Last minute behavior of the customer has been strengthened vs 2020. Clients are booking later and later due to lack of visibility on the travel rules and despite flexible cancellation policies adopted by the operators. And No doubt, this will continue to be the reservation behaviour in the future.

40% of all my bookings are confirmed 2 days before arrival”. And this island located in the Caribbean archipelago is a long haul from Europe!" Pierre said in Martinique

2 In the market trend reports, canceled transactions for WeYield clients for the month of July have been multiplied between 2 to 10 vs the same month last year.

“Last Spring estimated trends have been confirmed: an extreme volatility of the demand due to travel restriction or simply lack of visibility on the regulations” stated Benjamin from France

3 The lack of British in most of the destinations has hit the volume performance but boosted the RPD up between x2 in Caribbean islands to +30% in Europe. This high score ever is due to the combination of two main factors

overall retail price increase on the various distribution channels

the reduction of the volume of days due to shorter duration even though the tourists wish to optimize their stay due to the eventual travel quarantine constraints

4 For the fleet, except in Europe where it increased by +9%, all the markets monitored by WeYield Market Trends reported a big reduction between -10 to -30% in capacity. No doubt that the cost of the supply and the tension on the manufacturing production side have triggered a reduction on the purchase orders. But, mostly, the car rental operators have played a prudent game in their fleet planned for the summer.

“the Covid has forced us to reduce the staff. So the fleet plan was reduced accordingly” commented Kristinn from Iceland

As a yield management expert, I can emphasize that for the first time in recent history, some car rental companies have started to yield. The reduction of capacity combined with an increase in price generated for July 2021 a Revenue Per Available Car (RevCar) between +9% in Europe, +70% in Mediterranea and x2 in Caribbean.

Hopefully, car hire operators will maintain this tactic in the future to continue boosting their performance. What learning can be carried back? In case of a demand increase, monitor it like the hot milk with reliable data, start increasing the price (for which there is no cost) before buying more cars. Because, when the utilization pressure is on the car rental operator’s shoulders, it is used by the clients (Brokers or corporate accounts) as a leverage to pull the price down. And this spiral should stop. For the sake of the companies’ profitability.

About WeYield

WeYield is a yield management transformation company which developed state-of-the-art technology. We aim to help car rental operators which are frustrated by their current processes and want to change to increase their performance. WeYield is a French company supplying more than 100 clients over the 5 continents and are either franchisees from the international brands or independent operators.